Singapore Property Residential Report Q1 2019

Long term prospects remain strong despite short term weakness

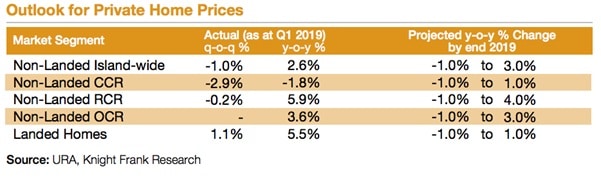

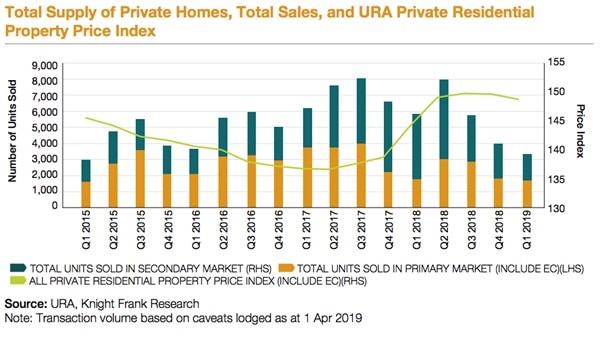

- Private Residential Property Prices faced some downward pressure (Figure 1) from slower sales as demand remained lacklustre on the back of July 2018’s additional cooling measures as well as an uncertain global economic picture.

- Despite subdued outlook for private residential market after the announcement of the eighth round of cooling measures in July 2018, developers were still actively seeking sites that have great connectivity and potential for future growth, demonstrating their confidence in the long term potential of the Singapore property market.

Figure 1:

Foreign demand declines seen due to uncertainty in global economic outlook amongst other factors

- Prices of the non-landed properties in Core Central Region (CCR) were largely expected to be more resilient than prices of those outside CCR but the decline in foreign demand saw the price index for CCR non-landed private residential properties declined by 2.9% q-o-q. The price index for non-landed properties Outside Central Region (OCR) remained flat. The price index for non-landed properties in the Rest of Central Region (RCR) also stayed largely unchanged, dipping marginally by 0.2% q-o-q.

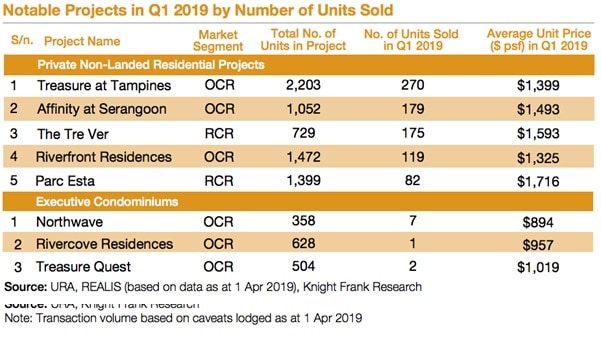

Cross-Island Line – Finding a good reason to buy now

- The announcement of the Cross-Island Line in end January was likely to have supported some of the prices of non-landed properties in OCR and RCR in Q1, in particular the projects which are closer proximity to the future MRT stations. Phase 1 will comprise 12 stations passing through Ang Mo Kio, Hougang, Tampines, Pasir Ris and Changi Aviation Park.

- Affinity At Serangoon, The Florence Residences, The Garden Residences and Riverfront Residences were sold mainly because of their proximity to the MRT stations along the Cross-Island Line.

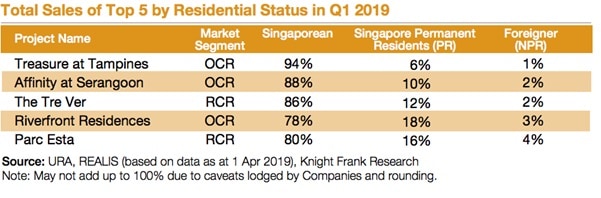

The units of the top selling projects were mainly purchased by Singaporean citizens.

Market Outlook for 2019

Overall sales is expected to remain moderate for the rest of 2019 due to the growing mismatch of price expectations between buyers and sellers, as well as the relative uncertainty about the global economic prospects.

- The recent announcement of the Draft Master Plan 2019 may encourage more sales in areas that are earmarked for future development.

- The property outlook for non-landed properties in CCR can be expected to stabilise after the announcement the initiatives to rejuvenate the CBD and Orchard Road, as well as the development of the Greater Southern Waterfront.